Let’s work together to build something amazing. Share your project details and our team will reply to figure out the next steps to your success.

Hopin’s $400 million funding round made waves due to its size and allowed the 28-year-old founder, Johnny Boufarhat, to sell $100 million of his shares. This unprecedented deal for a private company of Hopin’s size signifies a seismic shift in the startup world, giving more power and leverage to founders. Traditionally, founders had to wait for an IPO or acquisition to cash out, but Hopin’s funding deal showcases how some founders can now negotiate secondary share sales during funding rounds. This article dives into the implications of this trend, draws lessons from previous founder share sales, explores the rise of micro-VCs, analyzes Hopin’s strategy to win over skeptical investors, and looks ahead to the company’s future.

The $100M Deal That Shook Up the Startup World

Hopin’s $400 million funding round made headlines, not just for its large size but because it allowed the 28-year-old founder, Johnny Boufarhat, to sell $100 million of his shares. The deal is unprecedented for a private company of Hopin’s size and signals a seismic shift in the startup world that favors founders.

Founders Can Now Negotiate Secondary Share Sales

A few years ago, startup founders typically had to wait until an IPO or acquisition to cash out shares and earn a significant financial windfall. But Hopin’s funding deal shows that it is changing as some founders now have the leverage to negotiate secondary share sales as part of funding rounds. By selling $100 million worth of stock, Boufarhat instantly gained financial security that most startup founders can only dream of.

Share Sales Demonstrate Founders’ Power in Negotiations

The share sale highlights how much power founders wield in negotiations with investors. Boufarhat convinced new and existing investors to buy his shares at Hopin’s $5.65 billion valuation, even though the deal meant their ownership would be diluted. The fact that investors were willing to agree to this shows how intense the competition has become. Founders can demand more founder-friendly terms, and secondary shares will likely become common.

Risk of Secondary Share Sales

However, secondary share sales also introduce new risks and uncertainties. They could negatively impact startups’ cap tables by transferring shares to investors with different priorities than the founders and early backers. The sales also fuel concerns about startups being overvalued if founders can cash out at high prices before companies have proven their long-term viability.

Hopin’s whopping $400 million round and Boufarhat’s $100 million share sale demonstrate that we’ve entered a new era where startup founders call more of the shots. While this shift will produce more founder success stories, it also brings new challenges that could impact the startup ecosystem. Investors may need to rethink their approach to regain more leverage in negotiations.

Lessons From History: How Tech Founders Have Cashed In

Hopin founder Johnny Boufarhat is one of many startup founders who sell shares for a sizable sum. However, the timing and amount of his share sale are unprecedented for a young startup. Previously, founders typically only cashed in shares once their company had gone public or been acquired.

Snapchat

One of the first examples of a startup founder selling shares early on was Evan Spiegel, CEO of Snapchat. In 2017 Spiegel sold $750 million worth of Snap stock shortly after its IPO. While controversial, Spiegel’s share sale showed other founders that selling shares pre-IPO or acquisition could be possible with the right investors and metrics.

Asana

A few years later, the founders of Asana, Dustin Moskovitz and Justin Rosenstein, sold $150 million in shares to investors. Asana was still private then but had a $1.5 billion valuation and several years of solid growth metrics to help justify the deal. These sales indicated a shift in investor mindsets, as some were now willing to buy shares from founders before a liquidity event.

Hopin’s Effect on Share Sales

Hopin’s $100 million share sale represents the most significant amount a founder has cashed in from a private, venture-backed startup. At just two years old, the deal signals that some investors are now comfortable with founders selling shares just a couple of years into a startup’s life, provided there is a clear path to future success.

However, share sales of this size are still relatively rare. Hopin had to find investors who believed in Boufarhat’s long-term vision as CEO and his personal financial goals. Not all startups can replicate this type of deal, but it paves the way for more founders to consider negotiating share sales earlier in their startup’s lifecycle.

The Rise of the Micro-VC: Why Startups Now Have More Leverage

The venture capital landscape has changed dramatically in recent years with the rise of micro-VCs or small venture capital firms. According to PitchBook data, micro-VC funding has grown from 5% of all VC deals in 2010 to 25% today. These smaller firms, typically managing under $100 million in capital, have increased thanks to lower costs of starting a fund and new investment models like rolling funds.

The Benefits of Micro-VCs

The influx of micro-VCs benefited startup founders. With more firms competing for deals, founders can shop around the most founder-friendly deal. Startups had little choice but to accept whatever terms were of them.

Micro-VCs’ rise has also allowed more niche or unproven startups to get funded. Smaller firms can take more risks on new concepts or inexperienced founders. This has enabled more diversity among funded startups. However, micro-VCs typically have less capital to support startups through multiple funding rounds. Startups often have to patch together funding from numerous small investors or eventually turn to larger VC firms for later-stage funding.

Hopin – Competition Among Micro-VCs

Hopin is a prime example of a startup that likely benefited from competition among micro-VCs. The video events platform negotiated an extremely founder-friendly $6.5 billion valuation and the option for its CEO to sell $100 million in shares just a year after launching. While risky, the deal paid off for its lead investor as Hopin grew over 700% this year. The startup is now well-positioned to court larger VC firms for its next funding round.

Micro-VCs’ rise has shifted power dynamics in the startup world to benefit founders. With more investors vying for deals, founders can afford to hold out for those that meet their critical demands, like higher valuations, greater control, and options for personal share sales. This trend will continue as long as micro-VCs remain active players in startup funding.

How Hopin Won Over Skeptical Investors

Hopin’s $100 million funding round and founder share sale shocked a barely a-year-old startup. The deal was risky for investors, given Hopin’s sky-high $5.65 billion valuation and the fact that the bulk of the money went directly into the founder’s pockets. However, Hopin won over investors because of its exponential growth and straightforward path to monetization.

Hopin’s Innovative Technology

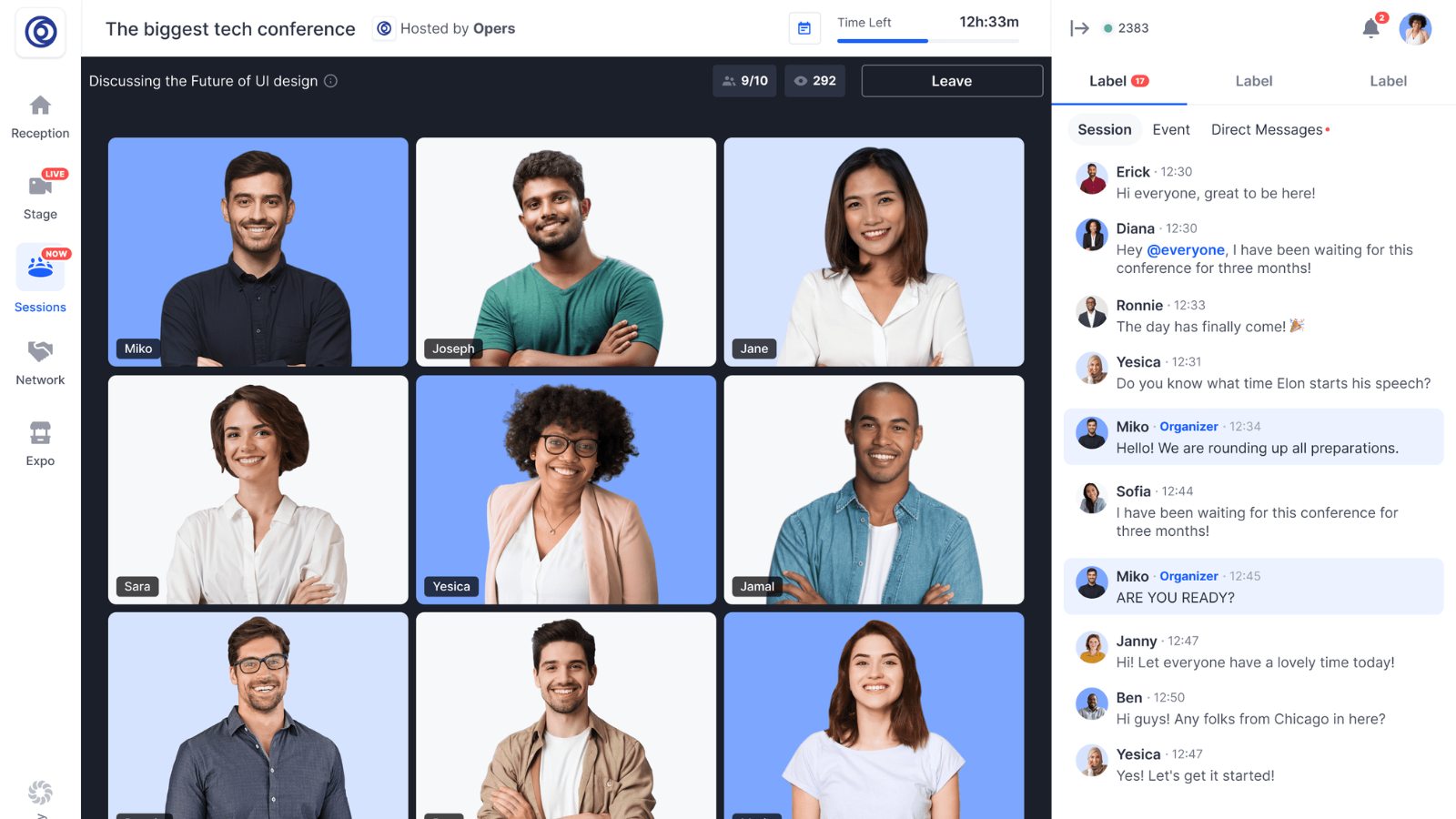

Hopin’s video conferencing platform launched in June 2019 but grew by over 3,500% in 2020 due to the COVID-19 pandemic and the shift to virtual events. The startup hosts over 80,000 monthly events and has over 5 million active users. Despite its young age, Hopin’s revenue is on track to surpass $20 million this year.

Key Metrics and Growth Trajectory

The startup’s key metrics and growth trajectory likely reassured investors about its long-term potential. While Hopin’s valuation seems inflated, the pandemic has proven that virtual events are here to stay, and Hopin is well-positioned to dominate the market. The startup also has a straightforward model for making money through event sponsorships, ticket sales, and other virtual event monetization strategies.

Hopin’s Evaluation Challenges

However, Hopin’s exponential growth could only partially mitigate the risks of its sky-high valuation and founder share sale. There were concerns that the deal was driven by hype and FOMO (fear of missing out) among investors. The startup still faces significant challenges in sustaining momentum and scaling its platform. There were also fears that the founder’s newfound wealth could negatively impact his motivation and leadership.

Investors Saw Potential

Despite these concerns, Hopin was able to close the round, likely because investors saw more potential upside than downside. If executed properly, the startup’s key metrics, growth, and market opportunity suggest it could achieve a valuation well beyond $5.65 billion. Also, the founder’s share sale provides more capital to accelerate growth, and the founder’s motivation and leadership suggest the new deal may have little impact.

Hopin’s funding deal was a risky bet but one that could pay off hugely if the startup lives up to its promise. The deal exemplifies how breakout startups with solid metrics and growth have the leverage to push the boundaries of founder-friendly funding.

The $100M Question: What’s Next for Hopin?

With $400 million in fresh capital and its founder newly flush with $100 million in cash, Hopin now has ample resources to scale its virtual events platform. However, the startup also faces high expectations and new challenges.

Hopin Must Sustain Growth & Expand New Customer Segments

Hopin must show investors it can sustain its meteoric growth and expand into new customer segments. While the startup’s platform has proven popular for large tech conferences, Hopin has yet to demonstrate that it can attract a long tail of smaller businesses and events. With its large valuation and new funding, the company will be under pressure to tap into new growth opportunities quickly.

Johnny Boufarhat’s Motivations and Commitment to the Startup

The founder’s newfound wealth also introduces some uncertainty. Will the $100 million windfall change founder Johnny Boufarhat’s motivations or commitment to the startup? While Boufarhat claims the share sale will not impact his focus, such life-changing events can often alter people’s priorities and risk tolerance. Hopin’s investors and employees will likely watch Boufarhat closely to ensure his continued dedication.

Continuing as an Independent Company

At the same time, Boufarhat’s payout provides more security for the founder and his stake in the startup. With cash in hand, Boufarhat can turn down acquisition offers that need to meet his personal financial goals. The share sale also allows Boufarhat to retain a sizable equity stake, motivating him to continue driving Hopin’s success as an independent company.

With its considerable war chest, Hopin now has an opportunity to expand its product, team, and customer base aggressively. However, the startup faces pressure to move quickly and questions about how its founder’s new wealth might impact the company.

A New Era for Startup Founders

For too long, founders have had to bend to investors’ will to secure funding to build their companies. While investors take on risk by providing capital, founders also take on significant risk by dedicating years of their lives to building a startup.

Demand Terms to Fuel Founder and Startup Growth

Deals like Hopin’s signal that the pendulum is swinging back toward the founders. They can now demand terms that meet their personal financial and ownership goals and fuel their startup’s growth. This could include provisions to sell shares earlier, maintain a significant equity stake, or control their company. Investors who want access to the hottest startups must provide more founder-friendly deals.

Founder Empowerment

This shift will have a profound impact on the startup space. Founders will feel empowered to turn down deals that require them to give up too much ownership or control too quickly. With more leverage, founders can negotiate deals that set their startup up for long-term success instead of being pushed to achieve short-term outcomes like an early IPO.

Inspire Entrepreneurs to Start Their Own Companies

More control and financial upside will encourage aspiring entrepreneurs to start their own companies. If they know they have a chance to build a successful startup and achieve life-changing wealth, more people will pursue the startup dream. This influx of new ideas and talent will benefit our economy and society.

Founders & Investors Can Find a Middle.

There are risks with founders gaining more power. Poor decision-making is possible if founders lack experience or their newfound wealth reduces motivation. Investors also need to achieve adequate returns to continue funding startups. The Hopin deal is proof that startups and investors can find a middle.

A Future of Equitable Relationships With Founders and Investors

Startup founders are poised to enter a new era of freedom and control. Deals like Hopin’s $100 million share sale could pave the way for a more equitable relationship between founders and investors—empowering visionaries to build future companies. Founders and investors should see this as an opportunity rather than a threat. They can forge a partnership that spurs innovation and benefits society by coming together.

Get the latest news and updates from Aleph One in your inbox.