Let’s work together to build something amazing. Share your project details and our team will reply to figure out the next steps to your success.

Cold outreach to venture capital firms is difficult and time-consuming for most startups, with low success rates in generating interest and funding. For the right SaaS startup, however, a service like SuperWarm can provide valuable warm introductions to relevant, interested VCs. This article will explore whether paying $50 for every investor meeting through SuperWarm.ai is worth it. We will examine the benefits and drawbacks of paying for investor meetings, considering factors such as time efficiency, resource allocation, and the potential for accessing investors that may be otherwise difficult to reach. By diving into the nuances of paid VC introduction services, we aim to provide startups with valuable insights to make informed decisions about their fundraising strategies.

The VC Gold Rush is Over – Why Most VC Funds Fail

The venture capital industry has struggled in recent years. According to research from Cambridge Associates, more than 60% of VC funds fail to generate positive returns for their investors. This poor performance has led many limited partners—the institutions and individuals that invest in VC funds—to question the VC model.

Structural Issues with the Traditional VC Model

A few structural issues with the traditional VC model contribute to this high failure rate. First, VC funds have a fixed lifespan, typically ten years. This means VCs must deploy all committed capital during that period, even if good investment opportunities are scarce. This “use it or lose it” model encourages less disciplined investing.

High Fees

VC funds charge high fees, around 2% of assets under management and 20% of profits. These fees incentivize VCs to raise increasingly large funds, even if they cannot source and manage deals at a larger scale. High fees also mean VCs have to generate outsized investment returns to break even for their investors.

VC Deal Flow & Due Diligence May Be Too Slow

VC deal flow and due diligence have not kept up with the rapid growth in VC funds. According to data from Pitchbook, the number of VC funds has increased 10x since the 1990s, but the number of VC deals has only tripled. This mismatch means VCs compete fiercely for the best deals, which drives valuations and reduces potential returns.

While the VC model is under pressure, funding remains critical for scaling startups. Entrepreneurs should still value VC money but go in with realistic expectations about potential returns. For their part, VCs need to make structural changes to align incentives, improve deal flow, and ultimately generate better performance for their limited partners. With more discipline and curation, VC can still be a compelling asset class. But the days of easy money and unicorn chases are over.

The Benefits of Venture Capital Firms

Despite the troubles facing many VC funds, startup funding remains critical for entrepreneurs looking to scale their businesses. VC money fuels growth that would otherwise be impossible for most startups. With millions in funding, entrepreneurs can accelerate customer acquisition, expand into new markets, and build out their teams. This allows founders to focus on executing their vision rather than constantly fundraising to keep the lights on.

Credibility and Attracts Future Stakeholders

VC backing signals credibility and attracts future investors, partners, and customers. The due diligence conducted by VCs provides validation that the startup is onto something promising. This stamp of approval gives other stakeholders confidence that the risk is lower. The network and advice that comes with VC funding can open doors for young startups.

Share Vision and Business Understanding

While not all funding is equal, the right VC partner can be hugely impactful. For startups, the key is finding VCs that share their vision and values, understand their business and market, and have a track record of helping portfolio companies succeed. Despite the doom and gloom in some corners of the VC world, funds are still generating solid returns by betting on the right startups and helping them scale strategically.

Raising VC Funding Takes Work

For most startups, raising VC funding takes work. It requires developing a compelling pitch, crunching the numbers to build a realistic business plan, and networking to reach the right investors. But attracting VC interest is worth the effort required for startups with the potential to become sustainable, high-growth companies. VC money and expertise remain uniquely positioned to turn promising ideas into world-changing businesses. While VC is only for some startups, those with the ambition and ability to scale massively would be remiss not to pursue the best funding partners available.

While the VC model is far from perfect, VC funding is vital in enabling startups to achieve growth at scale. For the right startup, attracting VC interest should remain a priority to unlock the capital and resources needed to build an enduring company.

The Rise of SaaS and New Opportunities

Over the past decade, Software-as-a-Service, or SaaS, has emerged as one of the fastest-growing segments of the technology industry. SaaS startups have produced some of the largest tech IPOs in history, including Zoom, Datadog, and CrowdStrike. These massive exits have highlighted SaaS as an opportunity for VC investment.

SaaS Revenue Models Are Based on Subscriptions

SaaS businesses have several qualities that make them appealing to VC funds. First, SaaS revenue models are based on subscriptions, providing a predictable and recurring revenue stream. This mitigates some of the risks for VCs compared to models based primarily on upfront license fees. Second, SaaS metrics like monthly recurring revenue (MRR) and churn give VCs transparency into key business performance indicators. This data-driven approach allows VCs to monitor and evaluate SaaS startups.

SaaS Model & VC Investment Structures

The SaaS model lends itself well to new VC investment structures. For example, revenue-based investing, where VCs receive a percentage of monthly revenues rather than equity in the startup, has become popular for funding SaaS companies. This model provides startups more flexibility while giving VCs an opportunity for high returns on their investment.

More Competition in the VC Space

However, the rise of SaaS has also led to more competition for VC deals in the space. As more VC funds target SaaS startups, valuations have increased, and deal terms have become more founder-friendly. For VCs, finding and vetting the most promising SaaS startups is challenging, given the number of new companies launching each year. Startups also face more competition in attracting VC interest and investment.

Still, VC funding remains within reach for the right SaaS startup with a proven business model and strong metrics. By understanding VC motivations and priorities, SaaS founders can make a compelling case for investment. For VCs, rigorous data and performance analysis, focus on high-potential niches, and new investment models will be crucial to success in the competitive SaaS market. With no slowdown for SaaS innovation, VCs and startups alike have much to gain by refining their approach to this sector.

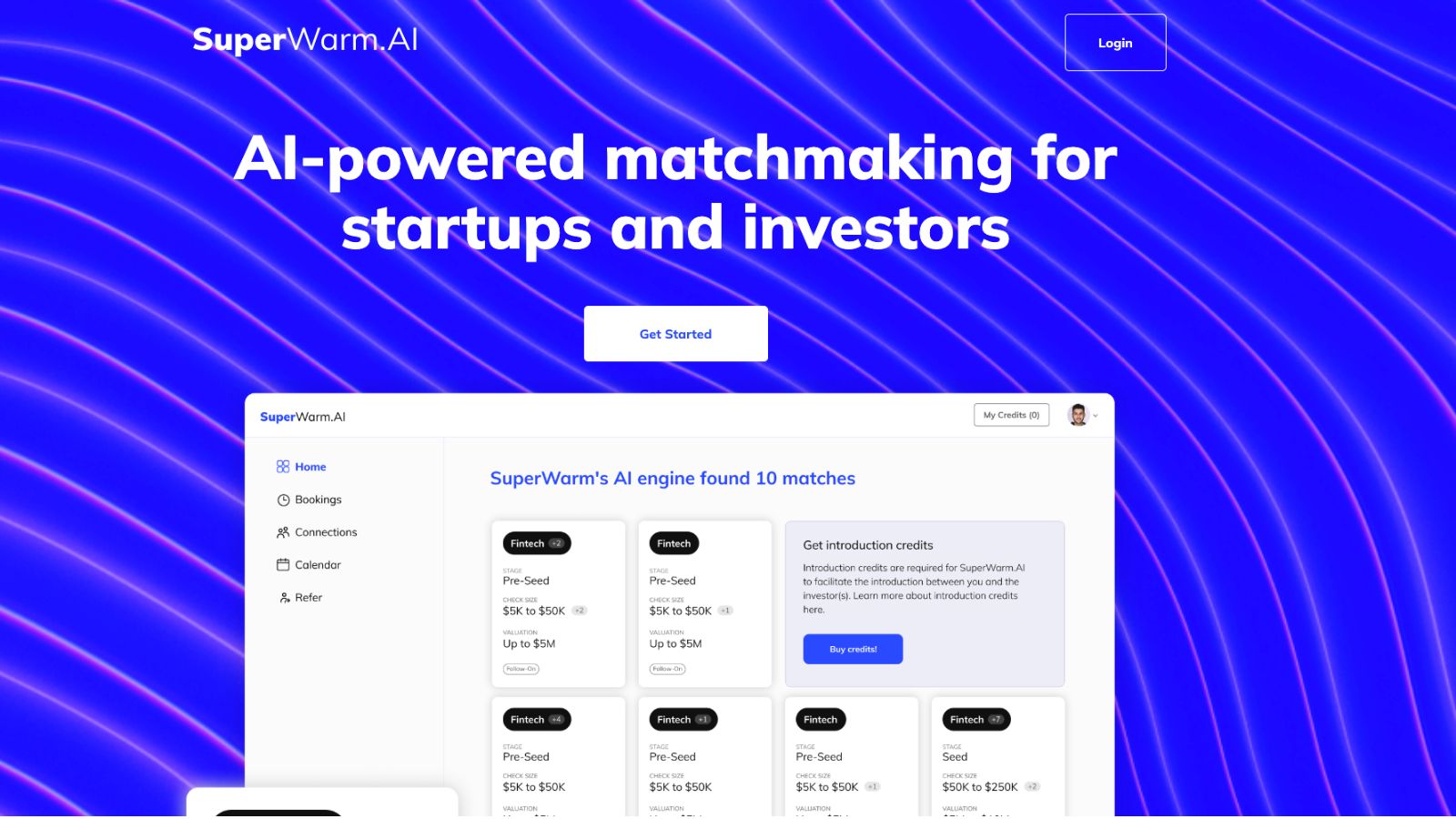

Superwarm vs. Cold Outreach: Why Paying for Intros Can Work

Cold outreach to venture capital firms is difficult and time-consuming for most startups, with low success rates in generating interest and funding. For the right SaaS startup, however, a service like SuperWarm can provide valuable warm introductions to relevant, interested VCs. By paying a few thousand dollars, startups can access VCs that have opted-in to meet with curated companies.

Benefits of Paying for Intros

While paying for introductions is controversial, it can be a valuable tool for efficiently allocating time and resources for some startups. Startups have limited bandwidth, and every hour spent researching VCs, crafting personalized emails, and following up on unresponsive leads is an hour not spent building the product or serving customers. Services like SuperWarm aim to solve this problem by qualifying VCs upfront based on areas of interest and only connecting startups with a high likelihood of interest.

Zenefits & Cadre – Paid Intro Led to Funding

For example, the HR SaaS startup Zenefits found early funding through a paid intro service, and the real estate tech company Cadre also used a paid service to see one of its first investors. While there is no guarantee of funding, and startups still need to make a strong case, warm intros at least get a foot in the door.

Networking Tool

Critics argue startups should never pay for introductions and that the best VCs will invest based on merit alone. However, VCs have more demand than supply, and most rely heavily on personal networks and intros to source deals. A paid service is another networking tool for startups to employ as long as they go in with realistic expectations. The key is finding the right service targeting VCs interested in your sector, stage, and business model.

If leveraged correctly and selectively, paid VC introduction services have the potential to save startups time and help them connect with investors they may otherwise need help to reach. For the cost of a few consulting hours, the reward of finding the right VC match could be well worth the risk.

What Startups Should Consider Before Paying for VC Intros

Before paying for introductions to VC funds, startups should carefully consider if they are ready for fundraising and VC investment. Spending for intros when a business needs to prepare can save money and time.

Determine If Your Startup Needs Outside Funding

First, startups need to determine if they need outside funding at their current stage. It may be too early for VC if the business still validates its model or has limited metrics to share. However, VC could be appropriate if the startup has strong growth and retention numbers and needs fuel to scale.

Evaluate Key Metrics

Startups should evaluate their key metrics and milestones to ensure they have a compelling story to share with VCs. For SaaS companies, metrics like MRR, churn, LTV, and CAC are essential. The startup needs to demonstrate how it can achieve exponential growth over time.

Consider Current Investor Interest

If the startup already has strong interest from angel investors or seed funds, paying for VC intros may be optional. However, a paid intro service could help open doors for startups with little existing investor interest.

Have a Polished Pitch Deck and Financial Model Prepared

Once a startup determines they are ready to pursue VC funding, they need to make the most of any introductions they receive. This means having a polished pitch deck and financial model and being prepared to answer tough questions about their vision, market, product, team, and growth strategy. Startups should research any VC funds they are introduced to speak knowledgeably about the fund and its portfolio.

Evaluate Different Paid Intro Services

Finally, startups should evaluate different paid intro services based on their experience, networks, and track record of success in their industry and stage. Some services may focus on specific sectors or stages, while others take a more general approach. Startups should ask for customer references and examples of successful fundraisers through the service.

With the right preparation and diligence in selecting an intro service, paying for VC introductions can be well worth the investment for a promising SaaS startup looking to scale. But only a few intros can compensate for lack of traction or compelling business fundamentals.

The Future of VC: More Data, AI and Remote Deals

In the coming years, the venture capital industry is poised for significant changes driven by data, artificial intelligence, and remote work.

Leveraging Data and Analytics

VCs have long made investment decisions based more on gut instinct than complex data. But VCs are following suit with startups increasingly leveraging data and analytics in their businesses. Funds are building proprietary algorithms and models to systematically evaluate startups on metrics like customer acquisition costs, lifetime value, and churn. While imperfect, data-driven VC can reduce reliance on personal biases and anecdotal evidence. The best funds will combine data with human judgment.

AI is Enabling New Ways for VCs to Analyze Startups

Machine learning algorithms can scan thousands of startups to identify patterns that lead to success or failure. AI can also analyze founder profiles, team dynamics, product roadmaps, and market factors to predict a startup’s likelihood of raising follow-on funding or getting acquired. Some VC funds develop their AI tools in-house, while others partner with specialized AI startups. AI will not replace human VCs but augment their decision-making.

Remote and Virtual VC Dealmaking

The COVID-19 pandemic has accelerated the trend toward remote and virtual VC dealmaking. Digital tools allow startups to pitch VCs through video calls, share documents in the cloud, and sign deals electronically. While in-person meetings are still preferable for relationship building, remote investing is more efficient and opens up opportunities for VCs and startups outside major tech hubs.

The New Era of VC is Here – Are You Ready?

The VC model has remained unchanged for decades, but data, AI, and remote work will usher in a new era of venture capital. Startups will have more opportunities to connect with investors but will face unique challenges in proving their merit based on algorithms and digital interactions alone. The most strategic VCs and startups will thrive in this new environment. These technologies will make VC more data-driven, scalable, and globally connected. But human judgment and relationships will remain at the heart of the best deals.

FAQ

What structural changes can VCs implement to align incentives, improve deal flow, and generate better performance for their limited partners?

To align incentives, VCs may consider implementing performance-based fees, linking fees to long-term portfolio outcomes, and offering more transparent reporting for limited partners. To improve deal flow, VCs could develop more focused investment strategies and leverage data and AI to process large amounts of deals efficiently. Finally, VCs may need to be more disciplined in their investment approach, focus on high-potential niches, adapt new investment models, and adopt a data-driven methodology to generate better performance.

How can startups effectively determine if they are ready for fundraising and VC investment before deciding to pay for introductions to VC funds?

Before paying for introductions to VC funds, startups should assess their readiness by evaluating their need for outside funding, examining their key metrics and milestones, considering existing investor interest, and ensuring they have a compelling story and polished presentation materials. If a startup confidently addresses these factors, it may be ready to pursue VC funding and consider using paid introduction services.

In what ways will AI and data-driven decision-making impact the dynamics between entrepreneurs and investors in the venture capital industry?

AI and data-driven decision-making will likely lead to a more objective and efficient evaluation of startups, reducing biases and anecdotal decision-making in the venture capital industry. As a result, entrepreneurs may need to present stronger data-backed evidence of their business prospects to gain investor attention. Additionally, the increased use of AI and data may improve the compatibility between investors and startups, with algorithms better able to match startups to investors who share their vision and values. However, human judgment and relationships will continue to play a crucial role in successful VC deals.

Get the latest news and updates from Aleph One in your inbox.