Let’s work together to build something amazing. Share your project details and our team will reply to figure out the next steps to your success.

As the world of startups continues to expand and evolve, securing funding at the early stages of development is crucial for success. Pre-seed funding is one of the first steps startups take to scale their technology.

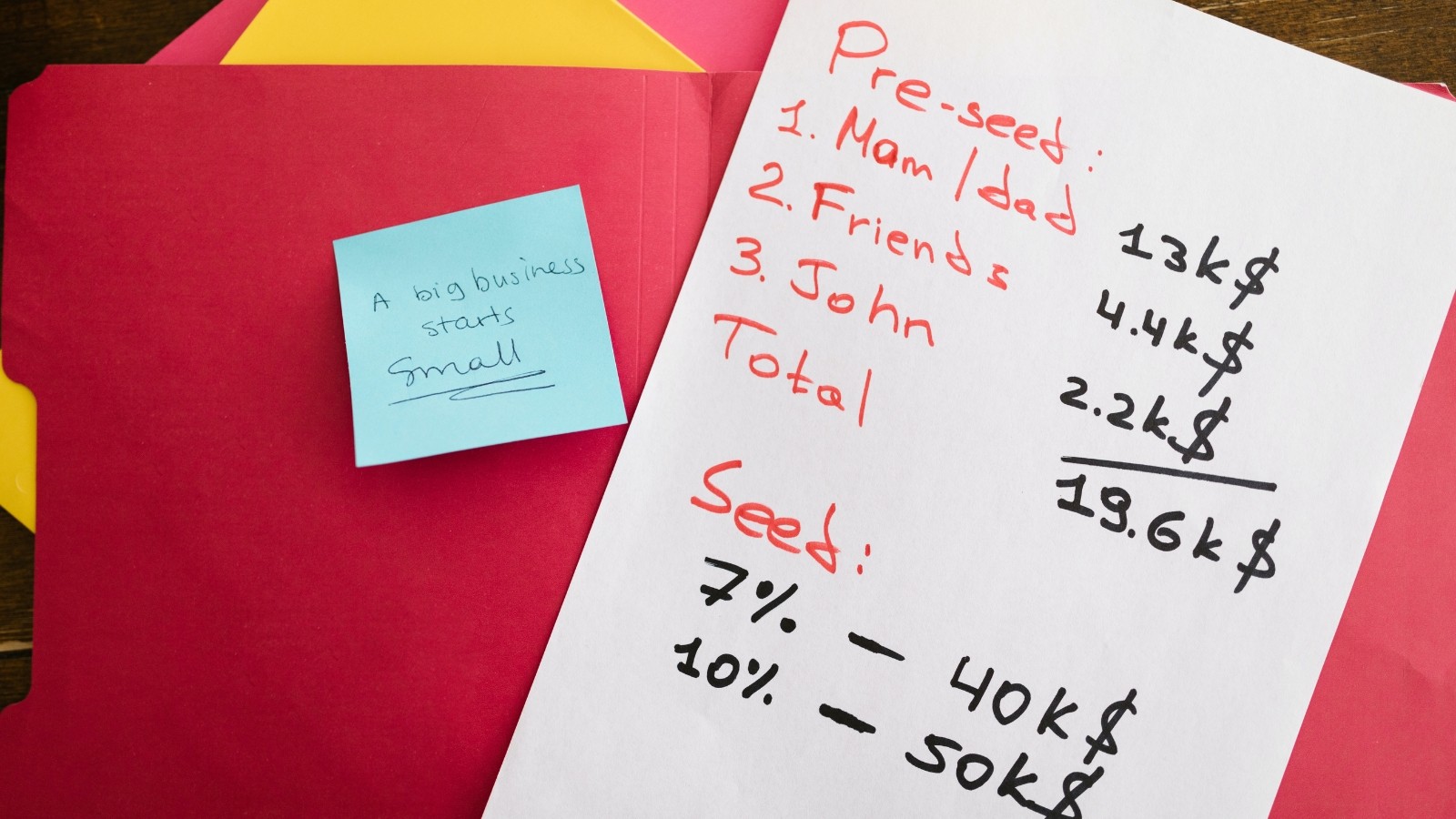

This initial round of funding covers product development, hiring, marketing, and operations expenses and is typically obtained from friends, family, accelerators, incubators, and angel investors.

While pre-seed funding offers many benefits for startups, it also has its risks. In this article, we will explore the advantages of startup pre-seed funding, compare it to seed funding, and provide insights for startups looking to raise funds at the early stages of development.

What is Pre Seed funding for startups?

Pre-seed funding refers to the initial round of funding that startups pitch for to build their tech product or service. This capital is usually obtained from private funding, friends, family, or angel investors.

Pre-seed funding is at the early stage of a company and is usually used to cover the startup’s expenses before it begins generating profits.

Advantages of Pre-Seed Funding

One of the significant advantages of pre-seed funding is that it allows startups to focus on tech product development and building their tech team without worrying about generating revenue immediately.

This can be particularly important for startups creating complex tech with lengthy development cycles.

Pre-seed funding can also help startups validate their business idea, increasing defensibility and attracting additional investment from seed investors later on.

Pre-seed funding is often obtained from friends and family or angel investors, who may be more willing to take on risk than traditional investors. This can allow startups to prove themselves before seeking more significant funding from risk-averse investors.

Overall, pre-seed funding can provide startups with the resources and time they need to build a strong foundation for their company.

Risks of Pre-Seed Funding

While pre-seed funding offers many benefits for startups, it also has some disadvantages. One of the main risks is that startup founders may give away too much equity initially, which can lead to significant dilution in the future.

Another risk is that struggling to meet investors’ expectations can lead to strained relationships and potential conflicts in the future.

In addition, pre-seed funding is often obtained from friends and family or angel investors, who may have different experience or resources than institutional investors. This can lead to a lack of mentorship and support for the startup, hindering their growth and development.

By being aware of these risks of pre seed funding and taking steps to mitigate them, startups can increase their chances of success in the pre-seed funding stage.

How to Raise Pre-Seed Funding

Raising pre-seed funding for a startup can be a challenging process, but there are several steps that founders can take to increase their chances of success.

Here are some steps to start raising pre-seed funding:

- Build a strong network of potential investors.

- Go to networking events, conferences, or spaces where you can interact and connect with potential investors or partners. If you’re in the tech space, conferences like SXSW or Techstars Startup Weekend are important events to attend.

- Develop a clear and concise pitch deck.

- A compelling pitch deck that explains the startup’s tech and unique product is essential. Demonstrating a clear roadmap and strategy can decide whether to get funding or not.

- Showcase a strong team with relevant experience.

- The startup team is the foundation or the secret sauce that makes the company stand out. Having a solid team of experienced engineers, developers, and designers is what investors will recognize.

- Demonstrate a clear problem-solution fit.

- Tech products can be complicated to explain to investors who may not be field experts, but having digestible content that investors will understand that clearly solves a problem is essential. This can be done through storytelling, data points, and case studies.

- Be transparent and honest with potential investors.

- It’s important to be transparent with prospective investors from the start. Since it’s the pre-seed round, startups don’t have revenue yet or don’t have the technology fully developed. Building trust and being honest with investors is critical at this stage; this means not exaggerating potential profits or growth.

By following these steps, startups can increase their chances of successfully raising pre-seed funding and building a solid foundation for their company.

What is Startup Seed Funding?

Typically, startup seed funding is the stage after pre-seed funding, and this capital is obtained from venture capitalists and angel investors. These investors fund startups that have demonstrated significant growth potential.

Seed funding rounds typically range from $500,000 to $2 million, depending on the industry and the startup’s potential for growth.

Seed funding is a vital stage for startups as it helps to increase the company’s valuation and prepares them for future investment rounds.

The funding received at this stage is usually used to scale the business and expand its reach, helping startups to achieve their goals and reach their full potential.

Pre-seed Funding vs. Seed Funding

The main difference between pre-seed funding and seed funding is the stage of development the startup is in and the purpose of the funding.

Pre-seed funding is for startups in the early stages that need capital to build or validate their business idea. The capital during the pre-seed stage is pre-revenue, while seed funding is for companies that already have a product and are looking to scale and grow.

The startup usually has a lower evaluation during pre-seed because the company is still building out the technology. However, at seed funding, the startup may already have sales, customers, and a built-out product and roadmap; this means it will be more expensive for investors to buy in or obtain equity.

Raising money at pre-seed is often much faster than in the seed funding stage. At pre-seed, founders reach out to friends, families, and angel investors willing to take in more risk and see the startup accelerate with the initial investment.

Securing funding during the seed stage may take months because it is a bigger check, usually 100k+, upward to millions of dollars. Investors will take a longer time to assess due diligence.

It’s essential to know the difference between pre-seed and seed funding and how both have their pros and cons.

Aleph One’s Approach to Pre-Seed Funding as a Venture Studio

Aleph One is a venture studio and software development firm. As a venture studio, we invest 50k-100k in early-stage or pre-seed startups.

In addition to capital, we provide mentorship, guidance, and technical support, whether it’s helping startups create their first MVP, building unique features to their existing product, or being a technical co-founder.

At Aleph One, we want startups to succeed, and we act as strategic partners and investors. As a custom tech product builder, we work with a diverse portfolio of startups launching their product and scaling their growth. Learn more about our venture studio approach.

Are You Ready To Raise Pre Seed Funding?

Pre-seed funding is one of the first steps founders take to raise capital and build their startup. This capital helps founders create their teams, develop their products, and get their companies to launch. Through a successful pre-seed funding round, startups can validate their tech and, in the future, have a higher evaluation.

Whether your startup is early-stage or pre-seed, find out how Aleph One’s venture studio can aid in boosting your startup’s growth.

FAQ

How much funding is common for pre-seed funding?

Typically during a startup’s pre-seed funding round, checks range from 10,000 and upwards to 100,000 depending on the industry and level of tech.

Where do startups go for pre-seed funding?

Pre-seed funding is usually sourced from personal contacts such as friends and family or angel investors and venture studios.

How long should startup pre-seed funding last?

It all depends on the startup’s burn rate and how much they’re investing in talent, tech, and other operational costs. Typically it is around 12-18 months before startups will have to raise another. Hopefullyefully by then, they will have a more established product for a higher evaluation to justify more capital.

Get the latest news and updates from Aleph One in your inbox.